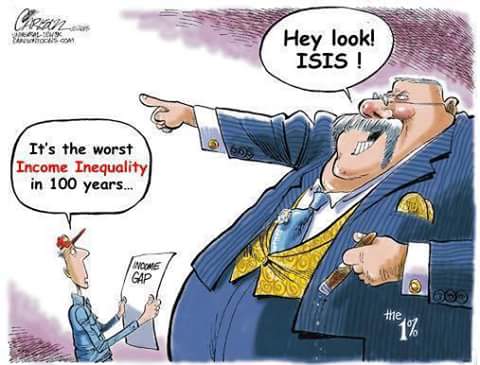

You know the plot: The bank robbers set off a bomb down the street from the bank, and while everyone’s distracted they get away with the loot.

In the reality TV show we’re now suffering through, Donald Trump is the bomb.

The robbers are the American oligarchs who bankroll the Republican Party, and who are plotting the biggest heist in American history – a massive tax cut estimated to be up to 5.8 trillion dollars.

Around 80 percent of it will benefit the richest 1 percent, according to the Tax Policy Center.

Trump is busily distracting America with his explosive tweets and incendiary tantrums – blasting Republican senators Jeff Flake and Bob Corker, NFL players who take the knee, Dreamers, refugees, immigrants, transgender people, the media, “rocket man,” Hillary Clinton, Obama, NAFTA, Muslims.

The Trump bomb is hugely damaging – unleashing hate, threatening democratic institutions, isolating America in the world.

But none of this seems to bother Republicans in Congress, except for a handful of Senators who won’t be running again. That’s because congressional Republicans are concentrating their efforts on pulling off the giant heist for their rich patrons.

They want to move quickly so no one notices – passing the tax cut before Christmas, with no hearings and minimal debate.

If the plot succeeds, most Americans will be robbed in three ways.

First, they’ll lose tax deductions they rely on – such as the deduction on earnings they put into tax-deferred savings in 401k plans. Some 55 million Americans now rely on 401(k) plans to save for retirement.

They’ll also lose the deduction for what they pay in state and local taxes. More than half of this deduction now goes to taxpayers with incomes of less than $200,000.

Republicans say the middle class will come out just fine because they’ll get a larger standard deduction. Not true. The average American’s tax bill will rise because the deductions they’ll lose will total more than the higher standard deduction Republicans are proposing.

Second, most Americans will lose government services that will have to be eliminated in order to pay for the giant tax cut – including, very likely, some Medicare and Medicaid.

About $1.5 billion in Medicare and Medicaid cuts were quietly included in the budget resolution Republicans just passed, in order to get their tax bill through the Senate with just 51 votes. (No one paid much attention because Trump was attacking grieving combat widows.)

Third, most Americans will have to pay higher interest on their car and mortgage loans and other money they borrow, because the huge tax cut will explode the national debt.

That debt is now around $20 trillion, or 70 percent of the total economy. If it goes much higher, it will crowd out borrowing and force interest rates upward.

Putting all this together, the theft would be the largest redistribution from the bottom 90 percent to the richest 1 percent in history.

Republican’s biggest fear is that word of the heist will leak out to the public, and their tax bill will be defeated by a handful of Senate Republican holdouts who feel the public pressure.

That’s exactly what happened with their plan to repeal the Affordable Care Act. The GOP’s big-money patrons pushed for repeal not because they had any principled objection to the Act, but because they didn’t want to fork over $144 billion in taxes on incomes over $1 million to pay for the Act over the next decade.

In the end, Republicans couldn’t get away with it because Americans learned that more than 23 million people would lose their health coverage, and Medicaid would also be on the chopping block.

Trump was willing to distract the public’s attention to give congressional Republicans a shot at repeal, but the moment the public started catching on he blew their cover. After the Congressional Budget Office announced the consequences of the Republican health bill, Trump called it “mean.”

He could do the same with the tax bill. He almost has. When word leaked out last week that Republicans were planning to limit 401(k) deductions, Trump tweeted that it wouldn’t happen (and then backtracked on his tweet).

The moneyed interests who run the GOP depend on the Trump bomb to divert attention from their huge heist. Their challenge is to make sure the bomb doesn’t go off in the wrong direction.

Robert Reich

SUNDAY, OCTOBER 29, 2017