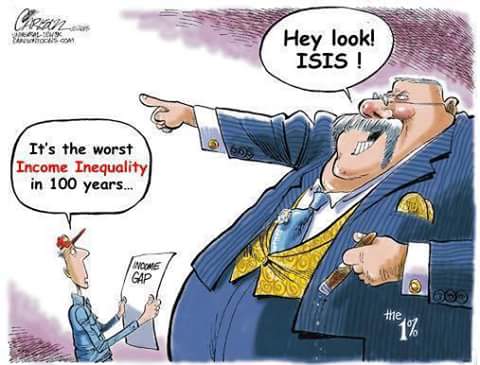

I have waited my entire life for this day. I knew it would come, sure as little fish make little fish, and here it is. No more Republican dickering at the edges of it, as they have through all these soft-pedal decades of trickle-down gibberish. No, they went for the thick red meat this time, the prime rib, and they don't frankly care if you know how badly you're getting screwed. Most people don't know. They will, alas, and soon.

The Republican tax bill is a done thing. It passed the House by a gruesome margin, only to be called back on procedural grounds regarding something Ted Cruz wants and something for-profit universities can't have. The Senate then passed it, and the House will pass it again today after they unsnarl last night's mess.

They cheered in the House when it passed the first time with no Democratic votes and all but 12 Republican votes. They cheered. When the time comes, remember that.The bill now awaits only the jagged, shuddering signature of this catastrophe president, like an earthquake signing its ruins with the Richter scrawl of its documented damage. Let the elderly wither, let the infirm wilt, let the students stumble, let the teachers flail, let the seas rise and the skies boil, let the future be only for the gilded few and everything else can fall to dust. They got what they came for, and the paymasters are pleased.

Mammon wins the day. Mammon, the ancient word for "money," adopted by the New Testament and John Milton as the very personification of greed, that which any God-fearing Christian must shun at the cost of their very soul, as explained succinctly in Matthew 6:24: "You cannot serve both God and Mammon." Yet on Tuesday night, the erstwhile "party of God" was busy dancing and cheering in delight around its golden calf.

They cheered. It would be bad enough if they did this with their heads hung low in shame, knowing as we all know that this is only happening because the big GOP donors demanded the key to the Treasury and refused to donate again until they got it. We're sorry, they could (but would never) say, but they made us do it. We had to, we're sorry. Instead, they cheered.When the president of the United States of America signs this bill into law, he will, among many other things, be signing a check to himself and men like Bob Corker. That check has a great many zeroes to the left of the decimal. These are the people the Evangelicals embrace as "theirs," though their pockets will be picked and their futures plundered, once again.

They actually cheered.

For the record: The people who will take this tax bill in the teeth reject and repudiate it out of hand. Only 33 percent of those polled by CNN think the tax bill is anything other than a smash-and-grab looting of the Treasury, and that number correlates exactly with the ever-dwindling number of people who think Donald J. Trump is himself the golden calf, beyond reproach, a shining orange beacon on a hill. If Trump threw out the first pitch at a ballgame and hit a grandmother behind third base with the ball, that 33 percent would call it a strike and denounce videotape footage to the contrary as "fake news."

I remember the quaint days of summer and fall, when the Republican Party could be counted on to be its worst enemy. Remember those attempts at repealing the Affordable Care Act, when GOP "heroes" like John McCain, Lisa Murkowski and Susan Collins thwarted the president and majority leader McConnell? That was only a few hundred billion dollars going to other people. This thing is a trillion dollars and more, all going directly to the wealthy and the corporations they control. McCain got a boozy tax break for his wife's portfolio, Murkowski got oil wells in the Arctic National Wildlife Refuge, and God only knows what brought Collins back into the fold; she will not be enjoying the aftermath, to be sure.

Do not despair. That which has been done can be undone. Trump has made it his mission to erase the very existence of his predecessor, like some tantrum-y pharaoh ordering the scourging of glyphs from the pyramid walls. Let him try. All works can be undone in time. Even this. Especially this.Prepare yourself for this in whatever way best suits. The thing that is about to happen today will be beyond your worst expectations. Donald Trump is going to strut and crow over a bill he has not read and knows next to nothing about, but will sign anyway because that is his purpose in life. It is entirely fitting that a gigantic legislative fraud will be made law by the biggest fraud in presidential history. It simply could be no other way.

They cheered. Never, ever forget that.

William Rivers Pitt

December 20, 2017